Table of Contents

Additional Praise for

The Risk-Wise Investor

“Risk—you must live with it, you can’t invest without it. Mike’s book does an excellent job explaining risk, and why we as investors (and real, live people!) need to understand this most basic element of our financial lives.”

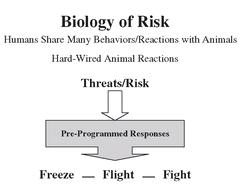

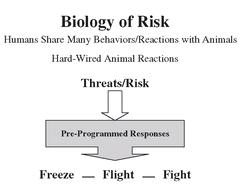

—E. Blake Moore Jr. CEO, Allianz Global Investors Fund Management“When investors are terrified, fight or flight—or freeze—are typical reactions, all of which destroy wealth! Mike Carpenter’s The Risk-Wise Investor offers a new and refreshing alternative, one investors (and their advisors!) can learn and profit from.”

—Charlotte B. Beyer Founder & CEO, Institute for Private Investors“A valuable guide for navigating uncertain times that every investor should read and add to their investment library.”

—Peter Jones Franklin Templeton Investments“When Michael Carpenter, a savvy, seasoned, and successful investment professional talks about risk, attention must be paid! This book is not a “how to” guide to becoming wealthy, but a rich compendium of tested strategies for protecting and growing your nest egg. Investors saving for retirement, for their children’s education, or for any long term goal will profit from it”

—Burton Greenwald BJ Greenwald Associates“Financial risk has been a subject that is intimidating and not well understood, yet today has become the financial topic! Individual investors want financial risk to be defined, assessed, and managed. This book allows the investor to accomplish each of these and build a financial roadmap to calibrate their personal risk exposure.”

—Phillip D. Meserve Financial StrategistCopyright © 2009 by Michael Carpenter. All rights reserved.

Published by John Wiley & Sons, Inc., Hoboken, New Jersey.

Published simultaneously in Canada.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 750-8400, fax (978) 646-8600, or on the web at www.copyright.com. Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 748-6011, fax (201) 748-6008, or online at http://www.wiley.com/go/permissions.

Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. No warranty may be created or extended by sales representatives or written sales materials. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Neither the publisher nor author shall be liable for any loss of profit or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

For general information on our other products and services or for technical support, please contact our Customer Care Department within the United States at (800) 762-2974, outside the United States at (317) 572-3993 or fax (317) 572-4002.

Wiley also publishes its books in a variety of electronic formats. Some content that appears in print may not be available in electronic books. For more information about Wiley products, visit our web site at www.wiley.com.

Library of Congress Cataloging-in-Publication Data:

Carpenter, Michael, 1947-

The risk-wise investor: how to better understand and manage risk/Michael Carpenter. p. cm.

Includes bibliographical references and index.

eISBN : 978-0-470-53094-8

1. Investments. 2. Risk management. 3. Investment analysis. I. Title.

HG4521.C2824 2009

332.6-dc22

2009013315

To Cindy

Wonderful wife, mother, and best friend

The smartest, sweetest, most patient

and understanding person I know

Preface

When you change the way you look at things, the things you look at change.

Max Plank

Nobel Laureate in Physics

Welcome and congratulations on your decision to read this book. Many people don’t realize that one of the most common characteristics of truly successful, long-term investors is their appreciation of the importance of investing their time, before they invest their money. Many of those investors learned the hard way the necessity of spending at least as much time understanding the risks of any potential investment, as well as the rewards, before investing their capital. They have found that the more they know about both the potential downside and the upside, the better decisions they make, and the more likely their investment decisions will pay substantial rewards.

User-Friendly Risk Management

Initially, risk management may appear to be a complex, highly technical, and daunting discipline. However, once you become familiar with the “Risk-Wise” approach you’ll see how user-friendly, nontechnical, and effective it can be. The fact that you are now investing your time to gain insights and improve your knowledge level of the enormously important subjects of uncertainty, risk, and risk management is a very positive step. Quite simply, not being aware of or ignoring the critical role risk management plays in successful investing is itself a primary investment risk. So you should congratulate yourself for identifying that overriding risk, acknowledging its importance, and investing your time in gaining a better understanding of risk and risk management. Those few steps alone set you apart from most investors and serve as a key predictor of your future long-term investment success.

The principal objective of this book is to help you become a true “Risk-Wise” Investor. It is focused on helping you to better identify risks, to reduce the likelihood and impact of risks that do occur, and to turn risks into inconveniences and even potential opportunities.

What Is a “Risk-Wise” Investor?

The term “Risk-Wise” Investor refers to any investors with the power of judging their risk/reward decisions correctly, and following the soundest course of action based on broad knowledge, understanding, experience, and preparation . Those simple, nontechnical attributes are the foundation of the entire “Risk-Wise” approach. They are the key to better understanding risk, and the risk management methodologies discussed in this book. They are also the very same factors that helped you learn how to become a master of risk management in dealing with the risks you face in your everyday life. In fact, it’s a fundamental truth of human existence that we are naturally fearful of what we aren’t familiar with or don’t understand. So the more you know and understand about anything, the less fear, better decisions, and fewer missteps you’ll experience, and the more successful you’ll be. That is especially true of risks. In the heat of our fast-paced modern lives, and our fascination and dependency on technology, we may have neglected to apply what has been known about effective risk management for centuries. Almost 150 years ago the great thinker and writer Ralph Waldo Emerson articulated a key foundation concept of effective risk management that is just as valuable today. He observed: “Knowledge is the antidote to fear.” Since fear is integral to our natural risk management system, that insightful observation reinforces the fact that improving our knowledge of risk is key to reducing our fear of risk and to opening the door to better risk management and becoming less anxious, more comfortable and confident investors. When increased knowledge of risk is paired with deeper understanding and thorough preparation, risks are managed much more effectively and our fears and anxieties are dramatically reduced. Simply stated, and with very few exceptions, what we know, understand, and are prepared for cannot harm us.

This important precept is extremely valuable to “Risk-Wise” Investors today. It serves as a guidepost in the continuous search for better ways to identify, understand, manage, and control risks. This strategy is also just as effective in addressing the newly evolving, and sometimes frightening risks emerging from our rapidly changing, faster-paced, more interconnected, and less certain world.

In reading this book you’ll become familiar with the basic practical knowledge, understanding, and preparation methods you’ll need to become a more effective “Risk-Wise” Investor, including: • Using a new empowering definition of risk to improve your investment success.

• Finding a time-tested way to reduce unpleasant, negative surprises.

• Reducing the severity of negative surprises, should they ever occur.

• Converting risks into “inconveniences,” and even potential opportunities.

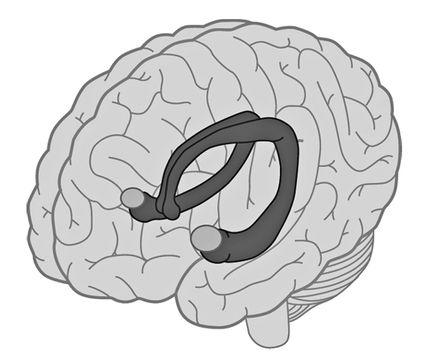

• Improving your investment success by understanding your risk biology.

• Seeing where and how to best focus your risk management resources.

• Learning how to know which risks should you avoid, accept, or manage.

• Creating a personalized, systematic process to better identify, manage, and neutralize the risks you face.

• Managing ongoing, ever-changing, and new risks.

• Better navigating extraordinary crisis events, bear markets, frightening volatility, and extremes of the business cycle.

Again, congratulations! Once you finish reading and absorbing the contents of this book, you’ll know and understand more about uncertainty, risk, practical risk management, and how to implement it for your personal benefit than the vast majority of investors. You’ll become a more “Risk-Wise” Investor. That knowledge and those insights will serve you well. They will help you better identify, understand, prepare for, and manage risk. You’ll enjoy the greater peace of mind that comes from truly understanding what you are doing and why you are doing it, plus you’ll avoid many of the potential pitfalls and investment nightmares that can occur along the way. Best of all you’ll improve the likelihood of reaching your personal financial objectives, regardless of the investment environment.

Acknowledgments

The fact that this book was conceived in the first place, let alone completed is due the ongoing encouragement, support, and help of numerous friends, neighbors, and associates all over the country.

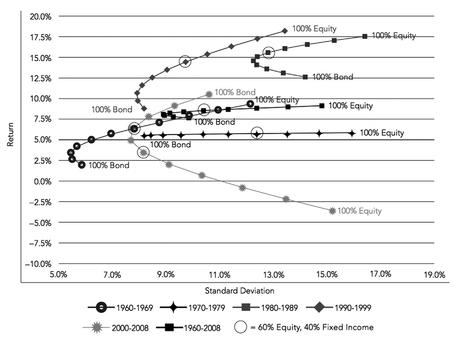

Enormous thanks are due to great friends John Riordan, John Nicholson, Rahoul Banerjea, and John Paolucci, whose continuous encouragement, questions, and comments helped me so much when I first became interested in researching and developing a user-friendly, nontechnical approach to understanding and managing risk. A tremendous debt of gratitude is owed to my friends and authors Jim Huguet for his sage counsel and educating me on the many issues facing a potential author, and Beth Birkman for graciously familiarizing me with the book publishing process, and for saving me an enormous amount of time and trouble in researching all that she was happy to share with me over a cup of coffee. Special thanks to wordsmith, author, and now retired risk management professional and consultant, Felix Kloman, for sharing his life-long passion for studying, observing, speaking, and writing about the multidisciplinary and ever-fascinating subjects of risk and risk management. His generosity in providing some key information on the history of risk management made my job much easier. Deep appreciation is also extended to friends and portfolio managers, Tom Goggins and Bill Hamilton, who shared their invaluable perspective as very experienced investment and risk managers. Thanks also to Jack Kenney, for his inspiration, counsel, and fine example of investment professionalism; Janice Reals-Ellig, for her encouragement; Dawn Kahler, for providing the efficient frontier studies; Todd Hiller, for his always thoughtful perspective and comments; and Ed Boudreau, for his suggestions and observations on risk management, from a private pilot’s viewpoint. Special thanks to former submariner Dave Wilson, Fire Chief Ken Willett, and Deputy Police Chief Barry Neil, for their insights into the unique challenges and risk management methods used by professionals whose job is to deal with life-threatening risks on a daily basis.

The deepest gratitude to my parents, Tom and Betty Carpenter, for their encouragement to always follow my dreams, and my brothers, John and Jim, and sisters, Cindy and Kim, for their love and unwavering support. Many thanks are also due to Nannette, Dean, and Ashley Carpenter, and Elizabeth Brodsky, for their technical help and support; senior management consultant, Paula Camara, for her always thought provoking questions and enthusiastic encouragement; and the extremely knowledgeable, helpful, and always friendly staff at the Boston Public Library and the library’s Kirstein Business Branch.

My appreciation is immeasurable for Tom Thomas and Dick Forbes, the two investment industry veterans who many years ago gave me the opportunity to first enter their incredible business, actually train on Wall Street, and build a career as an investment professional. I must also thank all the investors, financial advisors, and former associates, team members, executives, portfolio managers and consulting clients I’ve been unbelievably privileged to work with and continued to learn from over the years. You have made me feel truly blessed.

Last but not least, special thanks to Senior Editor David Pugh, Development Editor Kelly O’Connor, Senior Production Editor Michael Lisk, and Editorial Assistant Adrianna Johnson of John Wiley & Sons for their responsiveness, ideas, editorial assistance, professionalism, and help in making this book a reality.

CHAPTER 1

The Increasing Importance of “Risk-Wise” Investing

May you live in interesting times.

Ancient Chinese Curse

Our world, investment markets, and investing itself have changed dramatically in just the last decade. Investing has been irreversibly altered by a number of powerful, interrelated factors including:• Enormous growth in the volume, availability, and instant dissemination of investment information.

• Unprecedented expansion of the number and types of investment vehicles.

• A dramatic increase in the sheer number of investors, domestically and worldwide.

• An explosion in the total size of investment holdings.

• Huge increase in investors’ interest in, and knowledge of, investments and investing.

• The ongoing and remarkable lengthening of human life spans, raising the stakes and critical importance of investing successfully.

• The increased global interconnectedness of all investors, economies, markets, countries, and continents, and their growing interdependence on one another.

• The accelerating pace of worldwide change and all the uncertainties it generates.

• Enormously increased market volumes and at times gut-wrenching volatility.

These historic changes have created wonderful new investment opportunities and new challenges. They’ve increased the likelihood and impact of old familiar risks and totally new types of risks when the stakes for what’s at risk are now even bigger. With those dramatic and continuing changes, understanding and managing risk is more important than ever before.

The Holy Grail?

Based on what we see, hear, and read virtually every moment of every waking hour, each and every day, achieving outstanding investment performance is the Holy Grail of investing. It’s held up as the foundation of investment success. Enormous time, energy, and resources are devoted to identifying and urging us to take advantage of the newest, hottest investment ideas, best performers, and the next big investment winners all over the world.

For instance, the media overloads and overwhelms us 24/7 with analysts, pundits, seers, and prognosticators (often contradicting one another). They urgently forecast economic and market moves for the next year, quarter, month, week, hour, day, and unbelievably, even minutes, so that we can rush to take advantage of their insights. Simultaneously, we’re experiencing an enormous explosion in the number of new investment vehicles, trading tools, and information sources. We’re also seeing a deluge of new active and indexed investments strategies, all designed to “help us” make more money on both the positive and negative price movements of almost everything. We now live in an investment world offering more distinct types of investments to choose from, and more and different ways to make or lose money investing, than ever before in history. As more sophisticated active and index investment alternatives attract more assets and compete more intensively with one another, the range between strong and weak investment performance is also shrinking.

The same phenomenon is occurring with private equity, alternative investments, and hedge funds as well as many other investment types. As more managers with more assets under management chase similar opportunities, the range of performance narrows and gradually reverts to a tighter range, more closely grouped around the mean.

The Game Has Shifted

There is another change that’s occurred in the investment world over the last 20 years, which has been overlooked by many investors. The nature of this subtle, but very important change was first pointed out by renowned institutional investment consultant Charles Ellis in his thought-leading book, Winning the Losers Game.1 In his book, Ellis reviews why and how investing has shifted from a “Winner’s Game” to a “Loser’s Game.” He describes how the nature of the investment world has changed to now favor those investors who make the fewest mistakes rather than the investors focused on gaining the highest returns. He observes that the key driver of investing success has become similar to the success drivers in activities like golf and amateur tennis. In all these pursuits the winners win not by outplaying their opponents but by making the fewest mistakes. If you have ever played golf or tennis, you are undoubtedly familiar with this phenomenon, because the harder you try to win, the more mistakes you tend to make.

Investing changed to a loser’s game when large numbers of very bright people, with lots of resources, access to timely information, and lots of money to invest began competing with one another to achieve the best performance. The advantage now goes to investors who understand the benefit (using a baseball analogy) of the more consistent winning strategy of hitting lots of singles and doubles, getting on base regularly, and avoiding errors and missteps rather than having everyone of the team swing for the fence, attempt to hit home runs, and then strike out.

Ellis strongly emphasizes that the primary objective of investment management is risk management. Managing risk has always been important, but now emphasizing risk management and “Risk-Wise” investing is the most important investment success factor in achieving your long-term investment goals. Of course, this concept isn’t new or just limited to investing. It is also the fundamental core of the Hippocratic oath made by physicians for thousand of years: “First, do no harm.” Even real estate mogul Donald Trump has stated, “Protect the downside and the upside takes care of itself.”

That viewpoint is now also shared by the world’s largest business enterprises. In fact, the advantages of proactive risk management have become so important that within the last 10 years more and more large companies have created and staffed a totally new C-Suite level function focused on risk management. Adding to the long established positions of CEO, COO, CFO, CIO, CMO is the totally new position, and firm-wide department of the Chief Risk Officer (CRO). The underlying question though, is why? Why have these very sophisticated global enterprises felt the need to create a new senior executive position to oversee risk and risk management?

These multinational firms are placing such a big emphasis on risk management because they see and understand its tremendous value and realize:• In today’s world almost anything is possible (both positive and negative).

• Today’s stakes have never been higher, and risk management never more important.

• Offense wins games, and defense wins championships.

• If something can happen, it typically will happen (often at the worst possible time) unless action is taken on it in advance.

• It is critical to be ready and prepared for any contingency, no matter how extreme.

These huge enterprises understand how much more efficient and ultimately less costly it is to invest time and effort in being proactive, prepared, and ready for risks. It’s much preferable to paying the enormous tangible and intangible costs of being caught off guard, being unprepared for negative surprises, and furiously scrambling around to recover from risks when some of them inevitably become reality.

If major worldwide corporations, with all their resources and capabilities, are now focusing on risk and risk management throughout their entire enterprises, isn’t it even more important for individual investors to do the same? Individuals investing for their own and their family’s future carry the full responsibility of their future quality of life and prosperity, and it is all riding on their understanding and effective management of the investment risks they face. So where do you go to gain that critical understanding of such a multifaceted, multidisciplinary, and important a subject as managing uncertainty and risk?

The New Way to Gain Mastery

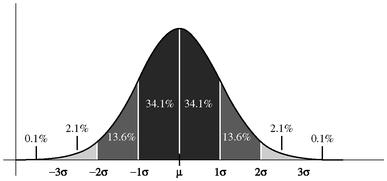

The big challenge for most investors in improving their knowledge of risk and risk management is that the subjects can seem complex, confusing, and even intimidating. When the unpredictability of the future is also factored in, the entire process can seem overwhelming and almost fruitless. As a result, many investors either give up on the effort right away or lose interest over time when confronted with the challenge. They just don’t have the extra time to dedicate to educating themselves on the complexities of the subject, with all the other demands on their attention. Even investors who are fully committed to improving their understanding of the subject are often disappointed, because most sources of information on risk management either oversimplify the subject or offer varying forms of technical overload. At one extreme are the sources that discuss the subject of risk and risk management simplistically and skim over it much too lightly. At the opposite extreme are sources that elaborate on highly technical, detailed, quantitative approaches (the details of Modern Portfolio Theory, the Efficient Frontier, quantitative analysis, variance, alpha, beta, and correlation coefficients, standard deviation) that don’t resonate even with many sophisticated investors, unless they also happen to be engineers, mathematicians, or statisticians.

The single most important thing to remember is that for any risk management approach to work, you must not only understand how the method works, but also why it works, so that you can understand its strengths and weaknesses. It also helps if, through personal experience, you know that it works under a full range of environments and circumstances. Next you must have enough knowledge of and confidence in the method to believe it will work, and then fully commit to it.

The most critical point to keep in mind is this: Any risk management system that any investor uses and does not understand, or does not have confidence in, will not work. The reason it won’t work is because investors who don’t truly understand and have confidence in their risk management methodology will many times abandon it, at the worst possible time. As a result, there is an enormous need for a user-friendly, knowledge-based, easy-to-understand, and easy-to-implement risk management approach. A new middle way is needed between the extremes of oversimplification and technical overload. That new knowledge-based, user-friendly alternative is the “Risk-Wise” Investor method.

The “Risk-Wise” Investor approach is specifically designed to help you and investors everywhere build a strong, knowledge-based understanding of risk and risk management in a practical, user-friendly, nontechnical, and easy to understand way. It is designed to increase your knowledge and understanding of risk management, and your confidence in your risk management abilities. It will also help its users make better informed investment decisions, reduce the number and impact of negative surprises, and improve the likelihood of investors achieving their long-term investment objectives. What makes the “Risk-wise” Investor approach so easy to understand and use is that you have and are already using it, very effectively, in numerous aspects of your daily life.

Release Your Own Natural, Everyday Risk Management Power

You are a very successful Master of Risk Management. Although you may be surprised by that statement, and may not actually feel like an expert risk manager, you indeed are one. In fact, you are an accomplished and very successful Master of Life-Risk Management if you are a normal adult human being. You are a Risk Management Master because you successfully deal with all kinds of risks (big, small, and some life threatening) multiple times, every single day. Your risk management skills are so well developed that many times you use them unconsciously. Just think about the life-threatening risks you take just driving to and from work or going out for simple errands, every single day.

You started learning about risks and risk management when you were very young. You survived all the risks of early childhood. You learned some of your risk management skills from your parents and siblings. They taught you about a full range of risks you faced and how to manage them. Unfortunately, some risks you had to learn about the hard way, and even today you may still carry the physical and mental scars from those painful lessons. If you have been or are now a parent, you know how often and how quickly small children can unknowingly place themselves in highly risky situations.

You’ve survived and learned to successfully manage the many dangerous risks of adolescence and the challenging teen years, when your emotions and raging hormones overruled your logic and controlled your actions. You may even remember some former personal friends from those days who weren’t as good at risk management or risk decision making as you and as a result didn’t survive their teens. In fact, teenagers are such a documented high-risk age group that auto insurance rates for teenagers and young adults are significantly higher than any other age group, except for those people well into their later senior citizen years.

When you graduated into adulthood you faced many new risks and learned how to manage them as well. The key point is that as adult human beings, we are all Masters of Life-Risk Management and very skilled in dealing with life risks. Not perfect by any means, because risk management is never perfect and accidents and mis-steps do happen. Even then, because we are prepared, we have mechanisms in place to minimize the impact of those surprises and almost inevitable accidents.

In general, adult human beings have extremely well developed risk management skills that are very easy to take for granted. Have you ever driven home, pulled in your driveway or garage and realized you don’t recall making any conscious decisions on your drive home? It’s as if you were on automatic pilot the entire trip. What’s really quite fascinating are the responses you get when you ask most people to describe what process they use so skillfully to manage the life risks they face every day. Most, even after thinking for a moment, can’t describe their risk management process because they don’t know it. They don’t think about it. They just do it. Those individuals have internalized their risk management process so much and become so comfortable with it that they can’t articulate what it is.

What would it be like if you could reconnect with the process you use so effectively to manage everyday risks and apply that same process and those same impressive risk management skills in the investment world? You would:• Better understand and manage risk.

• Make better, more knowledge-based investment decisions.

• Have more confidence in your risk management skills.

• Make fewer investment mis-steps and experience fewer negative surprises.

• Reduce the impact of the unpleasant surprises that do occur.

• Improve the likelihood of achieving your long-term investment goals.

• Be a happier more successful, less anxious, ready for anything “Risk-Wise” Investor.

The core of the “Risk-Wise” Investor method, and what makes it so different, is how it refamiliarizes and reconnects you with the very same process you have used in learning and developing your own everyday, and natural, life-risk management skills. It then provides you with a nontechnical, and easy to implement, step-by-step process to use in creating your own personalized risk management plan, and ongoing risk managed decision-making process. Let’s now review the steps in our everyday, natural life-risk management process and see how easily they transition into the “Risk-Wise” Investor method discussed in the next chapter.

CHAPTER 2

Introduction to the “Risk-Wise” Risk Management Process

If a man empties his purse into his head, no one can take it away from him. An investment in knowledge always pays the best interest.

Ben Franklin

What would it be like if you could be as accomplished and comfortable managing investment risks as you are managing the risks you face in your every day life? You’d make fewer investment missteps, and reduce the severity of the risks that did occur. You’d also increase the likelihood of achieving your financial objectives, and you’d be a happier, less anxious, more confident, more successful investor.

That’s the objective of the “Risk-Wise” Investor risk management method. My purpose is to show you how to use this user-friendly, easy-to-implement way to release your innate, natural, and highly developed life-risk management skills in the world of investments.

As adult human beings, we are all very accomplished, and very successful managers of the many risks we encounter in our everyday lives. Yet as comfortable and accomplished as we are with managing these everyday risks, we often feel quite uncomfortable and ill-equipped to manage the challenging and sometimes very painful risks of investing. Many investors have become so frustrated by their inability to effectively manage investment risks that they’ve come to see the investment markets as giant casinos, and investing as a crap shoot or game of chance. Although that’s not the case, those feelings of exasperation, frustration, and second-guessing our investment decisions are only natural. They result from the growing uncertainties generated by our increasingly faster-paced, rapidly changing modern world.

Frequently those feelings are further amplified by surprise crises, economic shocks, natural disasters, and geopolitical or economic turmoil. The added concerns generated by gut-wrenching market drops, and increased market volatility, which defy even the forecasting skills of the most experienced investment experts, can intensify those feelings to the extreme.

So what is the process we use to so effectively manage our everyday life-risks? Why and how can those same skills work just as well in the investment world?

That’s exactly what we cover in the rest of this chapter. We start by refamiliarizing you with your own highly developed life-risk management process. Then we review how to use the elements of that ingrained system as the foundation of your own, user-friendly investment risk management method, and close by introducing you to the basic steps of the “Risk-Wise” Investor risk management process.

Releasing Your Natural, Everyday Risk Management Skills

The more you become familiar with and use the “Risk-Wise” Investor risk management approach, the better you’ll understand and more effectively manage the risks you face now and in the future.

First, you need to refamiliarize yourself with the natural, step-by-step process you used in gaining your skill and comfort in managing everyday life-risk. However, that can be challenge for anyone; since by the time we reach adulthood the vast majority of us have internalized our risk management process so much that it has become automatic. We’ve become so comfortable managing life-risks; we do it on an instinctive level without even thinking about how we do it. In fact, when asked what process they use in managing their everyday life-risks, many people say that they don’t have a specific process. They just do it.

As such, I encourage you to take a moment right now to think through the steps you personally use in successfully managing the life-risks you face everyday. Then write those steps down. (Give yourself a little time to think about it and let it resurface, then write each step down in the spaces provided.)

Now, did the steps in your own risk management process come to mind easily, or did they require serious effort to recall? How successful were you in listing all the steps? How long did it take? If you are like most people, you found it surprisingly difficult for a process that you use so many times each and every day.

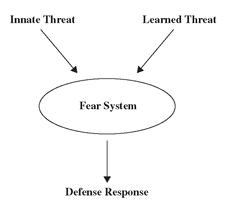

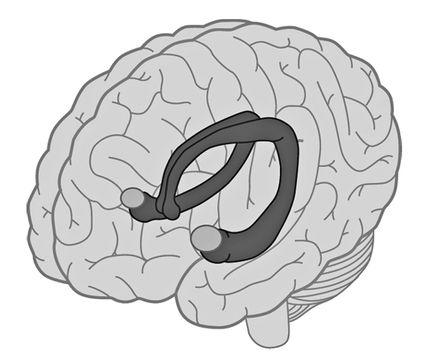

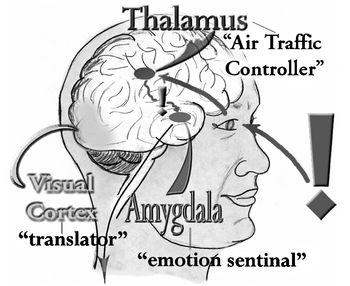

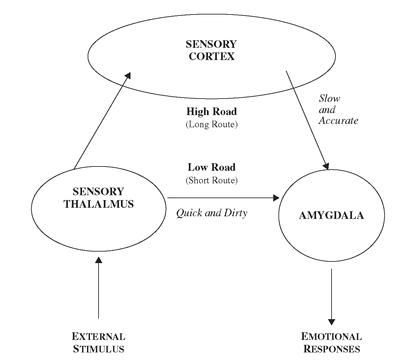

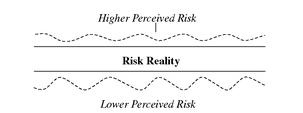

Although our bodies are hard-wired with many built-in, involuntary life-risk management systems (like our natural reaction to blink when something moves rapidly in front of our eyes or our instantaneous reflex reaction when we touch something hot), most of our life-risk management skills are learned skills. We learn them from our parents, friends, by watching others, and by ourselves.

Below is a quick review of the step-by-step process we humans use in learning how to so effectively manage the life-risks we face.

The Everyday Life-Risk Risk Management Process Steps

1. Identify Risks. Determine, and remember for future use those things that may cause harm or interfere with your physical health, goals, or objectives.

2. Understand Risks. Learn as much as you can about each potential risk, including its likelihood of occurring and its impact should it occur.

3. Review Risk Reduction/Risk Management Strategies Available. Become familiar with any and all strategies that can be used to avoid each risk, reduce the likelihood of a risk occurring, and minimize a risk’s impact should it still occur.

4. Evaluate the Risk/Reward Tradeoff (with and without risk management). Review the rewards of an action, or inaction, and the risk reduction options available to use versus the risks (likelihood and impact) of the potential action or inaction.

5. Make Your Decision to Act or Not Act. Once you identify and understand the rewards and the risks (likelihood and impact), have evaluated the effectiveness of the risk management strategies available to use, and have a full understanding of your risk/reward trade-offs, you then make your decision to either act or not act. You can then decide to avoid the risk entirely, act and accept the risk with risk reduction initiative(s) in place (reducing the risk likelihood and/or impact) or act and accept the risk with no risk reduction.

6. Implement your decision.

7. Learn and Adapt. Continuously learn from actual experience, then use what you learn to make better risk/reward decisions in the future.

Although these steps may at first seem simplistic, their ultimate risk management success is the result of each step building sequentially on the foundation of the one before to create a very powerful and effective risk management system.

Releasing Your Everyday Life-Risk Management Skills in the Investment World

As a result of its effectiveness and flexibility, you can apply that same basic, step-by-step, life-risk management process to managing investment risks, while paying special attention to some of the differences in managing investment risks versus real world, life-risks (Which we’ll cover in-depth soon.)

In addition, it’s very important to be patient with yourself. You gained your facility with managing life-risks over at least several decades. So remember, just like learning to do anything new, managing investment risks may initially feel a little awkward, cumbersome, and slow. However, the more you use it and repeat it, the faster, easier and more comfortable you’ll become. Then, over time, it becomes so automatic, internalized, and second nature, that you won’t even have to even think about it any more. You’ll just do it.

The Fundament Principals of “Risk-Wise”Investing

Before reviewing the “Risk-Wise” Investor risk management process it is very important to consider some basic facts about risk and its management. First, life, risk, and reward are inseparable, interconnected elements. In fact, just to live at all exposes each of us to numerous risks, not the least of which is day-to-day survival.

In discussing risk management, Walter Wriston, Former Chairman of Citicorp, Chairman of the Economic Policy Advisory Board for President Reagan from 1982 to 1989 and recipient of the Presidential Medal of Freedom said at www.online.citibank.co.in/portal/co/var.ppt: “All of life is the management of risk, not its elimination.”

This means that since it’s impossible to eliminate risk in life, we are all exposed to numerous kinds of risk whether we like it or not. As a result, since we can’t eliminate risk, we each must decide to either manage risks or be subject to their raw and potentially painful impact. Below are a few basic principals of risk management that are very important to keep in mind as you go about managing risk.

• Risk and reward are a normal part of life, of everything we do, including investing.

• Risk/reward trade-offs are integral to every decision, action, or inaction.

• Effective risk management is critical to long-term investment and life success.

• Risks can be managed, but never eliminated.

• You cannot effectively manage risk or uncertainty without understanding it.

• The more you know about risk and risk management the more effective you’ll be.

• Risk management will not work effectively if you do not understand how and why it works or have confidence in it.

• The most effective method of managing risks is to:• Become familiar with risks.

• Prepare for risks in advance.

When investing, the practical implementation of these risk management principles can best be achieved by using the same logical sequence of steps all of us use in our everyday life-risk management processes. The “Risk-Wise” Investor risk management method follows those steps, and in addition integrates into each step the special, unique considerations necessary for successful “Risk-Wise” Investing.

Building a Solid Foundation

Although the following process may at first glimpse appear simple and straightforward, don’t allow its simplicity to deceive you into underestimating its value and power.

Just because something is complex or quantitatively based, doesn’t mean it is necessarily better or more effective. Keep in mind what Benoit Mandelbrot, distinguished Sterling Professor of Mathematical Science at Yale University, one of the fathers of chaos theory, the inventor of the new field of fractal geometry (the geometry of nature), and extensive researcher of market price changes said in his excellent 2004 book The (Mis)Behavior of Markets. In discussing the efficient market hypothesis, which has been embraced by Wall Street, and become so popular with many academics, consultants, market analysts, and portfolio managers over the past 30 years, Professor Mandelbrot says, “Alas, the theory is elegant but flawed, as anyone who has lived through the booms and busts of the last decade can see.”1

As with any successful multistep process, each step of the “Risk-Wise” process is built on the previous one. The quality and effectiveness of your end results, and the risk management benefits you enjoy will depend entirely on how well and how thoroughly you complete each preceding step. With each step in this risk management process being the foundation of the next step, the book devotes considerable additional time to familiarizing you with key information, valuable insights, and important facts you’ll find essential in effectively building a solid foundation at each step of the “Risk-Wise” risk management process.

The “Risk-Wise” Investor—Risk Management Process Steps

Now that you’ve refamiliarized yourself with the steps in your own, everyday, life-risk management system, and reviewed the fundamental principles of effective risk management, it is time to introduce you to how to apply those insights in managing the risks in the investment world. Once you become familiar with the “Risk-Wise” Investor approach and begin using it more and more, you’ll gradually find yourself becoming as accomplished at managing investment risks as you are managing the everyday life-risks you face.

The “Risk-Wise” Investor Process

1. Personal Risk Assessment• Define risk (your definition of risk is the foundation of the entire process).

• Identify risks (you can’t manage a risk you haven’t identified as a risk).

• Understand risks (their likelihood and their personal impact should they occur).

• Determine which risks to avoid, accept, and/or manage.

2. Review risk reduction/management strategies available (their strengths and weaknesses).

3. Evaluate your risk/reward trade-offs (while avoiding common evaluation pitfalls).

4. Make your decision to act or not act—then implement it (while avoiding the common decision-making traps of many investors).

5. Effective ongoing risk monitoring and decision making (continuously being on guard for the emergence of new risks or threats and the evolving nature of known risks).

Building on this basic outline of the “Risk-Wise” Investor risk management process, the rest of this book will focus on how you can put each step of that process into action with extensive practical insights and valuable additional information that will help you build you own personal, customized risk management plan. We’ll review how to apply a new empowering definition of “risk” used by some of the top corporate chief risk officers (CROs) to your lifetime risk management and investment success. We’ll also discuss insights and lessons from the new field of behavioral finance and how to use them in avoiding very common risk/reward decision-making traps. In addition, we’ll cover a simple way to determine which risks you personally should avoid entirely, which risks to take and manage, and which ones to just accept.

On completing this book you’ll have also learned how to manage the full range of risks occurring in roaring bull markets; frightening bear markets; uncertain markets; and sometime the most challenging risks of all, the risks, traps, and pitfalls of our own, frequently flawed, decision-making biases. You’ll have everything you need to create and implement your very own customized, comprehensive, ready-for-anything investment risk management plan, and will be well on your way to becoming as accomplished and comfortable in managing investment risks as you are in managing your everyday life-risks.

CHAPTER 3

The Evolving History of Risk and Risk Management

Better to be wise by the misfortune of others than by your own.

Aesop

Of course risk and risk management are nothing new to human experience. They are as much a part of being human as living and breathing. Yet most of us know very little about how risk management has developed and evolved over time. So the very first step in improving our own knowledge and understanding of risk and risk management must be to become familiar with the history of this very important subject. Only then can we benefit from that knowledge in managing the risks we ourselves face today.

Rather than review the history of risk and risk management in detail, we’ll be taking a multidisciplinary, highlights approach. However, it can still benefit you greatly to study this very important subject in further detail. Therefore, I strongly recommend you read works such as Charles Kindleberger’s classic book on the history of financial crises, Manias, Panics, and Crashes, Peter Bernstein’s excellent history of risk, Against the Gods, and the classic, Extraordinary Popular Delusions and the Madness of Crowds, by Charles Mackay, and any of the many other fine books on the history of money, investing, and risk. You’ll be very glad you did.

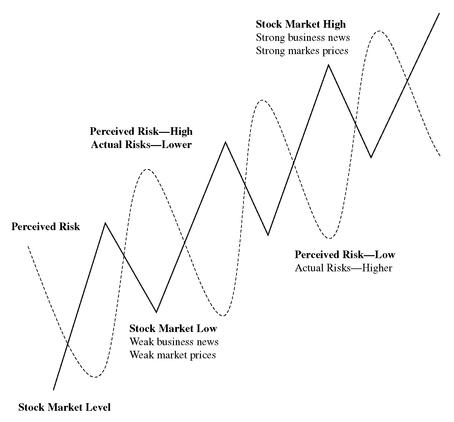

Historical Highlights

In reviewing this chronology, you’ll also see just how our world is becoming both safer and riskier at the same time. This seeming paradox occurs because as we live with established and familiar risks we gain control and mastery over them, and gradually we become less concerned about them. However, the accelerating pace of change and the ever-more-interconnected nature of our modern world means that new, unfamiliar, and often frightening risks we’ve never experienced before can pop onto the scene to challenge our risk management abilities. Simultaneously, we can also very easily fall victim to overconfidence in our risk management abilities, let down our guard, and end up paying a very high price for erroneously assuming that some of our old, familiar risks were fully under our control.

This overview of the history of risk and risk management addresses the gradual evolution of our risk management knowledge and skills over time. It highlights examples of our triumphs over some risks, as well as instances where risks have surprised us, harmed us, and taught us how to better deal with them in the future. This review is divided into three general sections, each coinciding with the three main eras in the evolution of our growth in understanding risk, risk management, and uncertainty:Part 1: A brief review of the ancient world through the Middle Ages.

Part 2: The pivotal role of the Renaissance

Part 3: The post-Renaissance period to the present.

This review is not meant to be a comprehensive study of the history of risk management but rather a quick, high-level overview of the growth of our knowledge of risk and risk management over time, better understanding, and a deeper knowledge of how we humans are gaining a better understanding of risk and how to manage it more effectively.1

Part 1: The Ancient Past (Pre-600 B.C.)

The fragile, and challenging nature of the hunter/gatherer lifestyle of very ancient times placed enormous demands on the ability of people to survive from day to day. Often referred to as the Ancient Past, this period lasted until about 600 B.C. in most parts of the world. Listed below are a few insights into what life was like for humans during that ancient period of time.

• People lived at the mercy of their environment and were consumed with the basic, continuous struggles of finding enough food, providing shelter for themselves and raising their offspring.

• The seasons, weather, and the availability of food dictated peoples’ lives.

• Human life spans were considerably shorter than they are today.

• One day was very similar to the next, with little change over time.

• Decisions were driven by instinct or the necessity to follow food sources.

• Men and women were truly passive before nature.

• Oracles, witchdoctors, astrologers, and soothsayers read the stars, entrails, smoke, dreams, and animal bones in an effort to help people gain insights into their uncertain future, and/or what the gods had in store for them.

• During this period people viewed their future as a matter of random chance, luck, and/or the vagaries of the forces of nature or the gods. Humans took what was dished out to them and did the best they could to deal with the conditions that were presented.

• People invented unseen forces and ascribed divine intelligence to natural phenomenon, which they then could blame for misfortunes, praise and thank for good luck, or sacrifice to in order to gain indulgences, favors and special requests.

• Gradually, people began to see natural patterns and began to use that knowledge to their benefit. They developed mechanisms and systems to deal with what they could expect as well as the occasional surprises that could occur, even if they couldn’t predict the exact timing or form of those surprises.

• People were unable to conceive of having any real influence or control over the circumstances of their lives.

Over thousands of years, farming, and then the domestication of livestock gradually developed. Those innovations led to the establishment of permanent villages, then towns, cities, states, and eventually empires. Even when towns and cities developed, people still had little or no control over their lives. Their futures were set out for them from birth. They were born into the vocation of their families, and even those individuals of noble birth had no real alternative but to live the life they were born into, in their particular locale. In fact, traveling outside their immediate home base was rarely done because of travel’s many dangers, perils, and uncertainties. People literally had little or nothing to say about their futures. Life was simple, hard, generally very short by today’s standards, and offered people few options and few opportunities to influence their fate.

Early History (600 B.C.-A.D. 500)

By 600 B.C. cities, kingdoms, and civilizations had developed. Many of the modern characteristics of civilized societies we know today were already in place and reasonably well developed. Yet humans still possessed very limited ability to control their lives or determine their own futures because so much of what happened to them was beyond their personal control.

In fact, generation after generation of Chinese, rather than use their own judgment, depended on the teaching and guidance offered in the I Ching. During their classic era even the Greeks, as culturally sophisticated as they were, still consulted the Oracle at Delphi for insights into the future on their most important issues. Here are some other insights into life during this period of early human history.

Sixth Century B.C.: The Chinese sages Confucius and Lao-tzu developed and taught their principles. Confucius emphasized self-cultivation and a preference for sound judgment, equilibrium and harmony, while Lao-tzu, the father of Taoism, was greatly influenced by nature and taught the benefit of letting events follow their natural course. This period also saw the beginnings of Greek philosophy.

Fourth Century B.C: Plato asserted that all things partake of two worlds: the visible world that is always changing and the intelligible world that remains unchanged

333 B.C: Alexander the Great expands the limits of what was ever thought possible, from the scope of his conquests, to demonstrating how effective out-of-the-box thinking can be in solving problems, when cleaving the Gordian knot with his sword.

49 B.C: Establishing a historic example of unalterable decision making, Julius Caesar crosses from Gaul into Italy over a stream called the Rubicon, breaking a Roman law forbidding any general to lead his troops onto Italian soil.

The Middle Ages (A.D. 500-A.D. 1500)

The Middle Ages lasted about a thousand years from the fall of the Western Roman Empire in the fifth century to the beginning of the Early Modern Period. The Reformation of Western Christianity, the growing view of the “dignity of man” in the Italian renaissance, and the beginning of European overseas expansion signaled its end.

This was truly a multiphased transition period lasting almost one thousand years. The following timeline briefly highlights some of the important characteristics of life during each of the major phases of the middle ages.

The Dark Ages (500-800) directly following the fall of the Romans was characterized by:• Elevated political uncertainties (in the vacuum left by Rome’s fall).

• A reduction in economic activity.

• Successful incursions into Europe by non-Christian peoples.

• The general loss of learning and literacy.

• The church and clergy were the unifying cultural influence, which also maintained the arts and knowledge of writing and reading.

The High and Later Middle Ages (800-1400): were characterized by:• A revival of urban and commercial life.

• The development of the institutions of lordship and vassalage.

• Castle and cathedral building.

• Mounted warfare and the Crusades.

• The rise of commercial interests.

• The great plague of the fourteenth century.

800-900: The Arabic number system (originally developed by the Hindus), which includes the new invention zero, becomes accepted throughout the Arab empire, and energizes the use of mathematics due to its ease of use compared to previous systems.

1066: The Norman conquest of England and the age of feudalism.

Eleventh Century 1100-1200: The foundations on which algebra is developed are articulated by the Persian poet, polymath, philosopher, teacher, and mathematician Omar Khayyam• The precursors of Universities like Oxford and Cambridge were first established as scholastic enclaves by religious monks

• Literacy started becoming more available to a wider class of people.

1215: The Magna Carta becomes the basis of constitutional government.

1291: Two hundred years of Crusading ends with the fall of Acre. While tens of thousands died in them, the Crusades led to Europeans being introduced to many new technologies, developed trade routes, and improvements in navigation. Silk, which was known to the Romans much earlier and new items such as gunpowder and navigational aids were discovered by the West, which made the great Age of Exploration possible.

Twelfth and Thirteenth Centuries: A dramatic increase in the rate of new inventions and innovations began taking place. These included invention of the cannon, spectacles, and cross-cultural introduction of the compass and astrolabe.

• Improvements were made to the design and construction of ships, improving seafaring.

• Great numbers of translations of Greek and Arabic medical and scientific works were distributed throughout Europe.

• Aristotle and his rational, logical approach became very important.

Part 2: The Renaissance

The major transition period between modern times and the past was the Renaissance. It began in the 1300s in Italy, spread to the rest of Europe in the 1400s and 1500s, and generated revolutions in art, science, culture, religion, and thinking. Listed below are a few high points of the period.

• Beliefs of more than 3000 years were openly challenged and left behind.

• Humans began to believe they could actually understand and gain control over their world and manage the risks they faced.

• Artistic expression blossomed.

• Scientific inquiry, knowledge, and interest exploded.

• Printing press is invented.

• New world is discovered.

• The incredible Age of Exploration begins.

• Commerce and trade blossomed.

• People could now earn wealth and were not limited to inheriting it.

• Superstition and tradition lost their strangleholds over people’s thinking.

• Serious study of risk and risk management began.

• A fourteenth-century English friar proposed Occam’s Razor, a rule of thumb for scientists and other trying to analyze data: The best theory is the simplest one that accounts for all the evidence.

Part 3: Entry into the Modern Age and Up to the Present

The late renaissance in the 1600s marks the beginning of the western world’s transition into the modern age. From this period onward, the pace of humankind’s growth in knowledge, progress and change has continued to accelerate up through the present day. The growth in our knowledge, understanding and management of risk is no exception. The following timeline reviews developments and events of note in that continuously evolving process. As you review this segment of the timeline, don’t focus so much on the details of each event; concentrate on the flow of events, the increasing pace of change, and the escalating importance of proactive risk management.

1620: Francis Bacon, English philosopher, lawyer and politician promoted the advantages of scientific study over inductive reasoning.

1630s: The Dutch issued and traded options securities virtually identical to those we use today.

1641: René Descartes, French philosopher, mathematician, and scientist proposed reason as a better way of gaining knowledge and established the foundation of the scientific method we still use today. He popularized the fundamental precept of sound reasoning, that anything must be doubted until it can be demonstrated or proved.

1650s:

• Printing and books had ceased to be a novelty.

• The Amsterdam stock exchange was flourishing.

• Blaise Pascal and Pierre de Fermat developed the basic concept of calculating probabilities for chance events from gambling.

1660: Pascal’s wager on the existence of God showed that the consequences of being wrong can be the most important factor to consider for a decision maker, rather than the likelihood.

1687: Edward Lloyd founds Lloyd’s of London in his coffee house. He creates a risk marketplace where first ship owners, and then others seeking insurance against financial risk, could acquire that protection from a risk taker (underwriter) for a mutually agreed premium payment by the insured.

1693: Edmund Halley, The astronomer famous for Halley’s comet, developed the first mortality (life expectancy) tables.

1703: Gottfried von Leibniz’s comment, “Nature has established patterns originating in the return of events, but only for the most part,” to math genius Jacob Bernoulli prompts Bernoulli to invent the Law of Large Numbers and statistical sampling. Bernoulli’s work then leads to the modern activities of statistical polling, wine tasting, stock picking, and the testing of new drugs.

1720: The “Bubble Year.” The South Seas Bubble in England, the Mississippi Bubble in France, and a remarkable range of other new investment ventures, many financed with borrowed money, all creating enormous speculative frenzy throughout England and Europe, finally collapsed. They financially devastated large numbers of individuals and institutions alike.

1730: Abraham de Moivre first demonstrated the structure of normal distribution of random events, introducing what we know today as the bell curve.

1738: Daniel Bernoulli created the basics of risk analysis by observing random events from the personal standpoint of how much an individual desires or fears each possible outcome, and he introduced the term utility to risk management. He stated that the desire of any individual for more over less is inversely proportional to the quantity of goods the individual already possesses.

1763: Housing, turnpike, and canal speculation throughout Europe.

1774: Dutch merchant Adriann van Ketwich creates the first investment fund, which he named Eendragt Maakt Magt or “unity creates strength,” on the principle that diversification and its resulting reduction of risk would appeal to smaller investors.

1793: English canal mania hits (bubble).

1797: Collapse of the French Assignat currency from hyperinflation.

1822: King Wilhelm I of the Netherlands launches the first closed-end mutual fund.

1825: Latin American bonds, mines, and cotton mania.

1847: Railway and wheat speculative excesses in England.

1848: Carl Frederick Gauss studied the blell curve, earlier described by de Moivre, and developed a structure for understanding random events that are large in number and independent of one another.

• Continued railway and public land speculation.

• California Gold Rush began with discovery of gold at Sutter’s Mill.

1873: Railroad, homesteading, and Chicago building booms in the United States.

1875: Francis Galton (the first cousin of Charles Darwin) discovered the concept of regression to the mean. That concept is based on his observation that although values in a random process can differ from the average value, in time they will move back to it. This concept will influence a number of areas, including investing, and can be recognized in everyday observations such as:• Why Pride goes before a fall and clouds tend to have silver linings.

• Why we make decisions based on extremes returning to normal.

1890: Silver and gold speculation leading to inflation (Sherman Silver Act in the U.S.).

1893: The Panic of 1893 and repeal of the U.S. Sherman Silver Act, which reversed previous excesses.

1900: Sigmund Freud’s analysis of the unconscious mind found that people’s decisions and actions can frequently be effected by factors concealed in the mind rather than by pure logic.

• The great Galveston, Texas, hurricane and tidal surge killed more than 5,000 people and destroyed the city in less than 12 hours, leading to dramatic changes in the scope and nature of weather prediction in North America and the world.

1906: 5:12 A.M., April 18, the Great San Francisco Earthquake began its 45-60 seconds of shaking, massive destruction, and raging fires. It led to over 2000 deaths, the demolition of the largest city in the western United States, and key lessons on the importance of managing the secondary and tertiary earthquake risks of weak building design and construction methods and poor fire preparedness.

1907: Coffee and rubber booms in Brazil and the United States. The Union Pacific Railroad boom.

• The Panic of 1907 A number of Wall Street brokerage firms went bankrupt, The Knickerbocker Trust and Westinghouse Electric failed, the Dow-Jones Industrial Average dropped 45 percent from its previous high, and J.P. Morgan brought together leading financiers to save the banking system and the economy.

• Irving Fisher, an American economist developed the concept of net present value as a tool to help make better decisions. He proposed discounting expected future cash flow at a rate that considers an investment’s risk.

1913: The U. S. Federal Reserve Bank was created to actively manage the very common boom and bust swings of the U.S economy and to act as lender of last resort to the banking system, should the need arise again.

1921: Frank Knight published Risk, Uncertainty, and Profit. The book became a keystone in the library of risk management. He distinguished uncertainty, which is not measurable, from risk, which is. He celebrated the prevalence of “surprise” and cautioned against over-reliance on extrapolating past frequencies/probabilities into the future.

• A Treatise on Probability by John Maynard Keynes appeared. He derided dependence on the Law of Large Numbers, emphasizing the importance of relative perception and judgment.

1923: The Germany Weimer Republic experienced hyperinflation, with prices for everything doubling every two days at its peak. Banknotes had lost so much value they were used as wallpaper.

1924: The first modern mutual fund (open-end investment company) was started in Boston by MFS Investment Management. Later the same year, State Street Investors Trust launched the second mutual fund.

1926: John von Neumann presented his first paper on a theory of games and strategy at the University of Gottingen, suggesting he goal of not losing is superior to that of winning.

1928: The first antibiotic drug, Penicillin, was accidentally discovered by Dr. Alexander Fleming, beginning the antibiotic revolution in medicine, reducing the risk of lethal infections and saving tens of millions of lives worldwide ever since. Example of logical risk management; First method to effectively reduce the common risk of death from infection.

• The first no-sales charge mutual fund was launched by the investment firm of Scudder Stevens and Clark of Boston.

• The first mutual fund to include both stocks and bonds, The Wellington Fund, was launched.

1929: There were 19 open-end mutual funds competing with 700 closed-end funds.

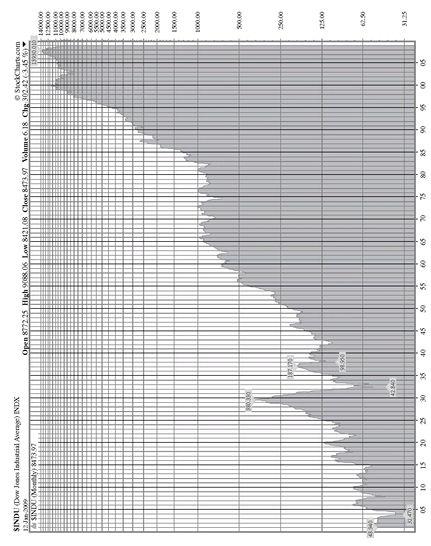

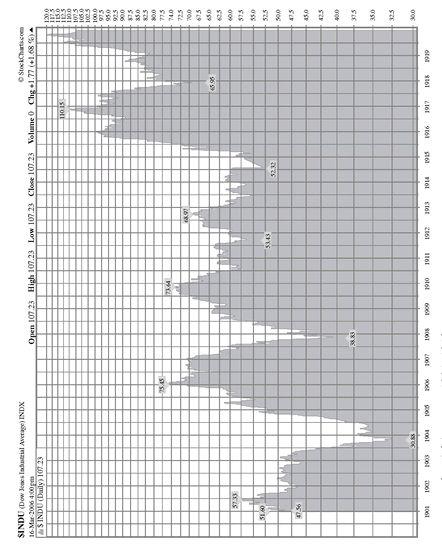

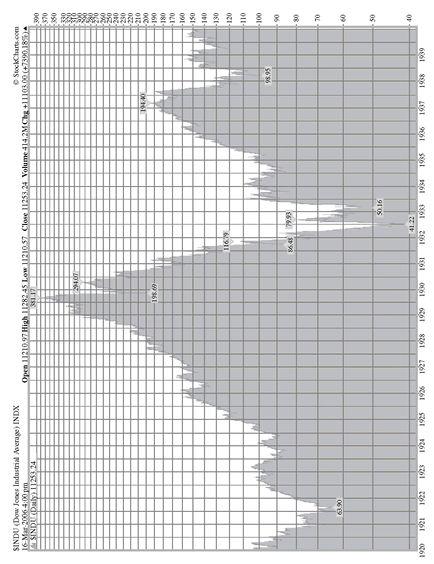

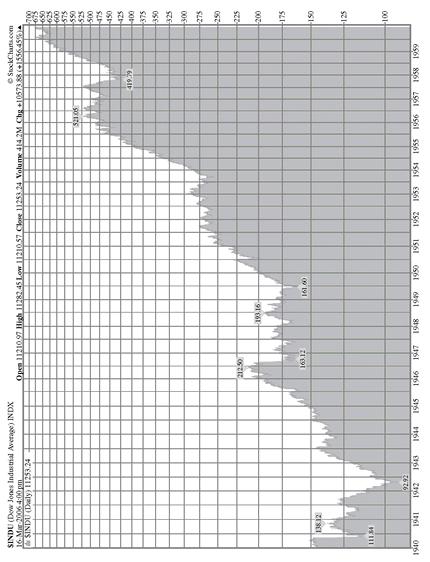

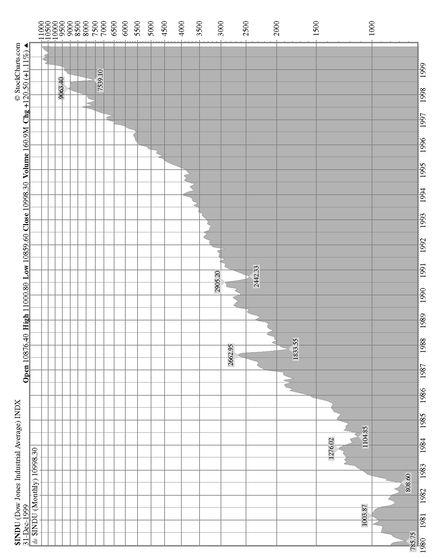

• In late October the stock market bubble, which had been building for over 10 years burst, dropping from a DJIA high of 381.17 on September 3 to a low of 41.22 on July 8, 1932. That drop created a total loss of 89.19 percent over that three-year period. It took until 1954, almost 22 years, to once again reach its previous 1929 high.

• With the stock market crash, the highly leveraged closed-end of the time were wiped out although smaller open-end funds managed to survive.

1933-1934: The Great Depression in the United States reached its deepest point.

• The U.S. Securities and Exchange Commission was created to regulate the securities markets (and improve risk management).

• The Securities Acts of 1933 and 1934 were enacted to safeguard and protect the interests of investors, and mutual funds were required to register with the SEC and provide disclosure in the form of a prospectus.

1944: John Von Neumann (also see 1926) and Oskar Morgenstern published their paper, “The Theory of Games and Economic Behavior,” which describes a mathematical basis for making economic decisions. They embraced the view that decision makers are always rational and consistent, in general agreement with most economic thinkers before them.

1945: The Atomic Age began; and the enormous rewards, risks, responsibilities, and related risk management issues raised deep concerns for all humankind.

• The Nuclear Arms Race initiated between the United States and the U.S.S.R.

1946: The Magic 8 Ball decision-making aid was invented by The Alabe Crafts Company of Cincinnati, Ohio. It was designed to help people make decisions under uncertain conditions.

1947: Rejecting the classical notion that decision makers behave with perfect rationality, Herbert Simon argued that because of the costs of acquiring information, executives make decisions with only “bounded rationality,” and make do with good enough decisions.

1952: Dr. Jonas Salk began human testing of his new (killed virus) polio vaccine, designed to neutralize the risk of polio, which at the time was everyone’s second-greatest fear after the fear of nuclear attack. Dr. Salk’s vaccine was finally declared safe and effective in April 1955. His vaccine, over time, virtually eliminated the risk of Polio, saved million of lives and untold suffering around the world.

• The Journal of Finance published “Portfolio Selection,” by graduate student Harry Markowitz, who later won the Noble Prize in 1990. It explained aspects of return and variance in an investment portfolio and why diversification works, leading to many of the sophisticated quantitative measures of financial risk in use today.

1956: The Harvard Business Review published Risk Management: A New Phase of Cost Control, by Russell Gallagher, then insurance manager of Philco Corporation. It highlighted the cost savings of risk management.

1960s: Edmund Learned, C. Rowland Christiansen, Kenneth Andrews, and others created the SWOT (strength, weaknesses, opportunities, and threats) model of analysis, and it became widely adopted as a practical decision-making aid.

1961: The term “Catch-22,” from Joseph Heller’s best-selling book, became popular for describing bureaucratic, frustrating, and illogical procedures that impede good decision making and risk management.

1962: Dr. Albert Sabin saw his oral polio vaccine (live-attenuated virus) approved by the FDA. Along with the Salk vaccine, it further contributed to the virtual elimination of the risk of polio throughout the world, within 40 years.

• Silent Spring by Rachel Carlson was published, challenging the public to seriously consider the risks of the degradation of our air, water, and ground from both inadvertent and deliberate pollution. This led to the creation of the U.S. Environmental Protection Agency in 1970 and the global Green movement so active today.

1964: Bill Sharpe articulated his Capital Asset Pricing Model in the Journal of Finance. He also developed what becomes known as the Sharpe Ratio, and eventually is extensively used to characterize how well the return of an asset compensates the investor for the risk taken. (Sharpe subsequently received the 1990 Nobel Prize in Economics along with Harry Markowitz.)

1965: The rear engine, compact car, the Corvair, manufactured by Chevrolet was exposed. Ralph Nader’s book Unsafe at Any Speed appeared and gave birth to the consumer movement in the United States, then throughout the world.

1966: “Nuclear option” became a widely used new term (based on the massive impact of atomic weapons) used to indicate the most extreme option when making a decision.

• The insurance Institute of America developed a set of three examinations that led to the designation Associate of Risk Management, the first such certification.

1968:

Decision Analysis, a book by Howard Raiffa, reviewed many decision-making techniques, including the use of decision trees and sampling to aid in decision making.

1969: In a triumph of stunningly successful risk management, focused effort, and technical achievement, in just about eight years President Kennedy’s 1961 challenge to “land a man on the moon and return him safely to the earth by the end of the decade” was spectacularly achieved.

1972: Dr. Kenneth Arrow and Sir John Hicks won the Nobel Prize in Economics. Arrow imagined a perfect world where every uncertainty was identified, the Law of Large Numbers worked without fail, then pointed out that our knowledge will always be incomplete and “comes trailing clouds of vagueness.”

1973: Fischer Black and Myron Scholes in a breakthrough academic paper, showed for the first time how stock options can be accurately valued. Their work began a transformation in the field of investment risk management. It took until the 1987 stock market crash and then again in the 1998 financial crisis (which was punctuated by the collapse of the hedge fund Long-Term Capital Management, where Black and Scholes were partners) for the flaws in their theoretical model to be exposed by actual financial panics.

• The OPEC oil embargo skyrocketed oil and gas prices, fuel rationing, high inflation, and extremely high interest rates.

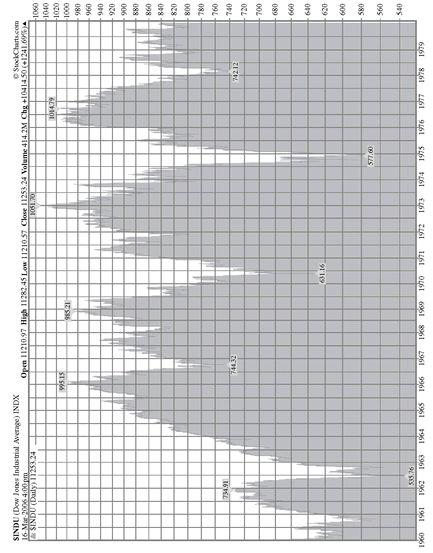

1974-1975: Crash in the price of stocks, REITs, office buildings, and 747 jetliners. (The Dow Jones Industrial Average dropped to 577.)

1976:

Fortune Magazine, with the support of the Risk and Insurance Management Society published a special article entitled “The Risk Management Revolution” articulating many ideas, which took over 20 years to be adopted.

• Hayne Leland and Mark Rubinstein, fellow finance professors at U.C. Berkeley developed the revolutionary idea for a new investment concept called Portfolio Insurance, which was designed to provide the upside potential in stocks with the downside limited only to an insurance premium (see the notes under 1987 to learn how well this innovation worked).

1979: Amos Tversky and Daniel Kahneman published their Prospect Theory, which established Behavioral Finance as a new academic discipline. They showed how the traditional rational model of economics incorrectly describes how people arrive at decisions when facing real-world uncertainties.

• The cover story “The Death of Equities” in Business Week magazine’s August 13 issue became a famous example of a contrary indicator, since within a few years the stock market began a 20-year bull run, increasing over 1000 percent by the end of 1999.

1980: The Society of Risk Analysis formed in Washington, D.C., to represent public policy, academic, and environmental risk management advocates.

• Through the SRA’s efforts the terms risk assessment and risk management became more familiar in North America and Europe.

• Monte Carlo simulations became popular in the theories of random walk, asset pricing, and finance, as a way of exploring a range of possibilities.

1983: William Ruckelshaus, the former director of the Environmental Protection Agency, delivered his speech on “Science, Risk, and Public Policy” to the National Academy of Sciences, launching the risk management idea in public policy.

• Risk management reached the national political agenda.

1984: The horror in Bhopal— 40 tons of poisonous methyl isocyanate gas were accidentally released from a Union Carbide chemical plant in Bhopal, India, killing 3,800 people and injuring 11,000 people. The accident served as a bellwether to the entire chemical industry and a catalyst for increased focus on risk management and safety reforms.

1986: Meltdown at Chernobyl: The Soviet nuclear power plant experienced a core reactor explosion as the result of a planned experiment that went bad. It sent a huge radioactive cloud into the atmosphere, immediately killing 31 people from radiation poisoning, forcing the evacuation of 130,000 people, and spreading radiation over most of Europe.

• Space Shuttle Challenger exploded just after liftoff on January 28, killing all crewmembers on board, setting the shuttle program back over two years, and becoming a horrific example of how even small errors in managing risk in complex systems can have catastrophic consequences.

• The Institute of Risk Management began in London establishing the first continuing education program in all facets of risk management.

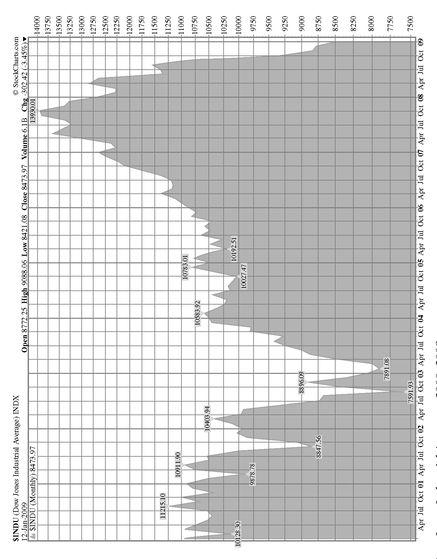

1987: “Black Monday,” October 19, 1987, hit the U.S. stock market. Its global shock waves reminded all investors of the risk and volatility in the markets.

• The Dow Jones Industrial Average (DJIA) dropped 508 points, to 1739 on record volume. The 22.5 percent one-day DJIA drop was the largest one-day percentage decline in stock market history and also set off record declines in stock markets around the world.

• The flaws of portfolio insurance, invented in 1976 (based on the quantitative Black/Scholes options pricing model) and then broadly used by institutional investors to reduce risk were widely exposed by the market crash. The inability to implement its strategies in a market route and the cost of portfolio insurance turned out to be much higher than the paper calculations had predicted, which invalidated the model. With the concept failing to prevent large losses, it totally fell out of favor and has not been used the same way since. As Michael Lewis said in the introduction of his book, Panic, The Story of Modern Financial Insanity, copyright 2009, and published by W.W. Norton & Company, “The very theory underlying all insurance against financial panic fell apart in the face of an actual panic.”

• Important assumptions concerning human rationality, the efficient market hypothesis, and economic equilibrium were brought into question by the event.

• Debate as to the cause of the crash of 1987 still continues many years after the event, with no firm conclusions reached.

1989: The Exxon Valdez super tanker ran aground on a reef in Alaska’s Prince William Sound and punctured eight of its cargo holds, spilling over 11 million barrels of crude oil into one of the world’s most pristine natural areas. The severity of the spill and the ineffective response to it created an economic and environmental disaster, leading to subsequent improvements in the design and construction of oil tankers and oil spill response preparation around the world.

• United Airlines Flight 232, while flying en route to Denver from Chicago, experienced an engine explosion, which expelled debris that severed all three hydraulic systems on the aircraft, leaving the pilot without any control of his DC-10. Through very unconventional methods, courageous effort, skill of the cockpit crew, and a highly coordinated emergency response, the plane was able to make a crash landing at the Sioux City, Iowa, airport. Due to outstanding risk management practices, both in the air and on the ground, of the 296 passengers and crew onboard, 184 people survived the crash. This event reaffirmed the importance of risk management planning and preparation.

1991: The spectacular bull market in Japanese stocks, The Nikkei Bubble ended, beginning a 14-year bear market.

1993: The title of Chief Risk Officer is first used by James Lam, of GE Capital, to describe the function of managing “all aspects of risk.” Today there are hundreds of CROs, globally responsible for the multiple risk management functions of their organizations.

1995: Rogue trader Nick Leeson, in Singapore, found he was disastrously overextended and managed to topple Barings Bank (known as the Queen’s Bank) within a couple of days, becoming a glaring example of insufficient financial risk management. Founded in 1762, the bank had financed the Napoleonic Wars, the Louisiana Purchase by the U.S. government, and the Erie Canal. At its demise, Barings was the oldest merchant bank in London.

1996: Risk and risk management made the best-seller book lists in North America and Europe with the publication of Peter Bernstein’s Against the Gods: The Remarkable Story of Risk. Now in paperback and translated into multiple languages, this single book, more than any preceding papers, speeches, books, or ideas popularized the understanding of risk and the attempts over the centuries to manage it.

• The Global Association of Risk Professionals (GARP) representing credit, currency, interest rate, and investment risk managers, began in New York and London. By 2002, with over 5,000 members and 17,000 associate members it had become the world’s largest risk management association.

• In the March-April issue of the Harvard Business Review, Peter Bernstein warned in his piece “The New Religion of Risk Management,” about the replacement of “old world superstitions” with a “dangerous reliance on numbers.”